Field Report: Consolidation of 4 Million UTXOs at Xapo

As mentioned in newsletter #3, the past few months of low transaction fees makes it a great time to do UTXO consolidation! Consolidation has been one of a variety of activities Xapo has been undertaking to be prepared for the next time fees spike like they did in the last few months of 2017.

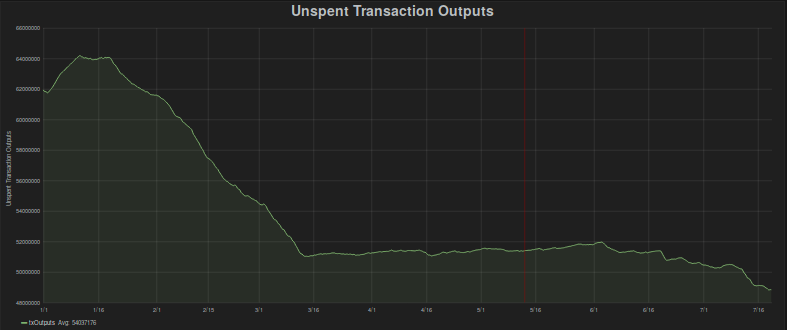

Plot of total Bitcoin UXTOs, January - July 2018,

source: Statoshi

The idea behind UTXO consolidation is essentially this: when your average outgoing payment is larger than your average incoming payment (or when they’re the same, but you’re batching outgoing payments), you’ll often have to combine many UTXOs in order to fund an outgoing transaction, which increases the size of your transactions and hence the fees you pay. By consolidating UTXOs in advance, you can combine inputs ahead of time, giving you more control over when most of those costs are incurred. If you can do it when fees are low, that lets you reduce those costs pretty substantially.

For example, if you would have spent a dozen 2-of-3 multisig inputs at 100 s/B (satoshis per byte), that would cost around 360,000 satoshis; while if you consolidated those inputs beforehand at 2 s/B, and then spent the single consolidated input later at 100 s/B, your total cost for the two transactions is only about 41,000 satoshis: i.e. 87% less paid in fees. And if fees don’t rise the risk isn’t huge: if fees just sat at 2 s/B, you’d be spending 7,900 satoshis across two transactions if you consolidated, rather than spending 7,200 satoshis in a single transaction if you did nothing.

Consolidation also gives an opportunity to update the addresses you use for your UTXOs, for example to roll keys over, switch to multisig, or switch to segwit or bech32 addresses. And reducing the number of UTXOs makes it easier to run a full node too, marginally improving Bitcoin’s decentralisation and overall security, which is always nice.

Of course, one thing you really don’t want to have happen is for your consolidation transactions to somehow fill up the blockchain and cause fees to immediately start rising! There are two metrics to watch to avoid this risk: one is whether the mempool is full (which causes the minimum acceptable fee to rise), and the other is how much empty space there has been in recent blocks (which gives an indication of whether miners will accept more transactions at the minimum fee). Both these metrics have been very promising most of the time over the past few months: the mempool has regularly been close to empty, meaning the transactions paying as little as 1 s/B have been propagated to miners; and many blocks have not been full, meaning cheap consolidation transactions will get mined reasonably quickly rather than creating a backlog that will cause fees to rise.

The approach we took to actually doing the consolidation was to have a script that would select groups of small UTXOs and create a consolidation transaction spending them to a single pool address at a fee rate of 1.01 satoshis per byte. The script gradually feeds consolidation transactions into the network, so it doesn’t cause too large a spike in the mempool, and perhaps more importantly so we don’t risk having our transactions get dropped because they have low fees and the mempool has filled up. We triggered this manually when we were comfortable it wouldn’t interfere with our operations, and when there didn’t seem to be much load on the Bitcoin network in general.

All in all, this has worked out pretty well; we’ve reduced our UTXO count by something like 4 million UTXOs this year, and aside from some concerned redditors, the cost to the network as a whole has been minimal, as has the cost to us.